Latest Version

10.46.2

October 17, 2024

Paytm - One97 Communications Ltd.

Finance

Android

0

Free

net.one97.paytm

Report a Problem

More About Paytm: Secure UPI Payments

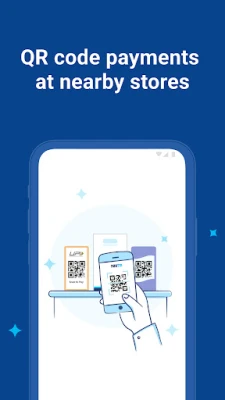

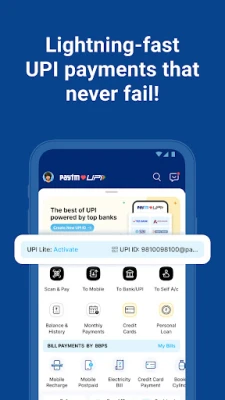

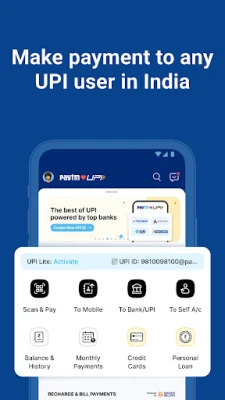

The Paytm app allows users to easily and securely send money to friends and family using their mobile number through the UPI feature. This includes people who are not on Paytm, making it convenient for users to transfer funds to anyone. Users can also make payments at various establishments such as grocery stores, petrol pumps, and restaurants by scanning QR codes.

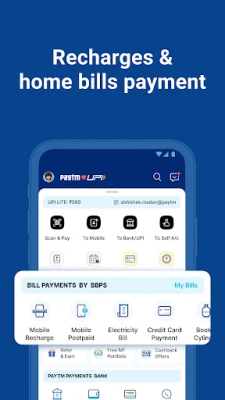

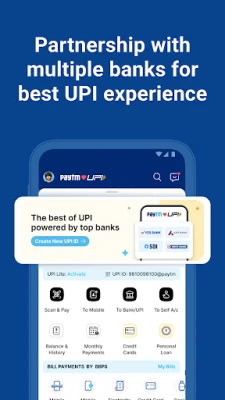

The app also offers the ability to recharge mobile phones and pay utility bills such as electricity, gas, water, and broadband. Paytm is powered by top Indian banks, ensuring a seamless and secure banking experience for all users. Users can also check their bank account balance and transaction history directly on the app.

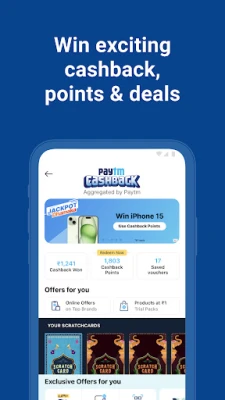

Paytm's UPI feature allows users to create a unique UPI ID and set a PIN for quick and easy payments. The app also offers the convenience of using the RuPay Credit Card for secure payments. Users can add their credit card to the app and make payments at any shop without the need for a CVV or OTP. They can also earn rewards and cashbacks on their Paytm payments.

The app also offers safe and contactless payments at offline stores by using the UPI Payments app, mobile number, or scanning QR codes. Users can also make payments at online stores for food delivery, grocery, shopping, and entertainment apps. Additionally, users can recharge their FASTag and order groceries, food, and home decor items through Paytm ONDC.

Paytm also offers the convenience of checking free credit scores and getting instant personal loans. The loan amount can range from 50K to 25 lac with a repayment period of 6-60 months and an annual interest rate of 10.99%-35%. The app also provides a list of lending partners for personal loans.

Users can also book tickets for trains, buses, and flights through Paytm, as it is an authorized IRCTC partner for e-ticket booking, cancellation, PNR status, and live train status. For any queries or concerns, users can contact One 97 Communications Limited, the parent company of Paytm, at their registered address in Noida, India.

Rate the App

User Reviews

Popular Apps

Editor's Choice

All Games

All Games Action

Action Adventure

Adventure Arcade

Arcade Board

Board Card

Card Casual

Casual Educational

Educational Music

Music Puzzle

Puzzle Racing

Racing Role playing

Role playing Simulation

Simulation Sports

Sports Strategy

Strategy Trivia

Trivia Word

Word Art & Design

Art & Design Auto & Vehicles

Auto & Vehicles Beauty

Beauty Books & Reference

Books & Reference Business

Business Comics

Comics Communication

Communication Dating

Dating Education

Education Entertainment

Entertainment Events

Events Finance

Finance Food & Drink

Food & Drink Health & Fitness

Health & Fitness House & Home

House & Home Libraries & Demo

Libraries & Demo Lifestyle

Lifestyle Maps & Navigation

Maps & Navigation Medical

Medical Music & Audio

Music & Audio News & Magazines

News & Magazines Parenting

Parenting Personalization

Personalization Photography

Photography Productivity

Productivity Shopping

Shopping Social

Social Sport

Sport Tools

Tools Travel & Local

Travel & Local Video Players & Editors

Video Players & Editors Weather

Weather Android

Android Windows

Windows iOS

iOS Mac

Mac Linux

Linux