Latest Version

2.0.0

November 08, 2024

Fast Online Loans

Finance

Android

0

Free

com.instant.cash.advance.loan.app

Report a Problem

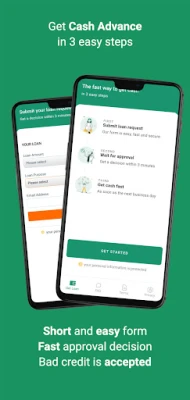

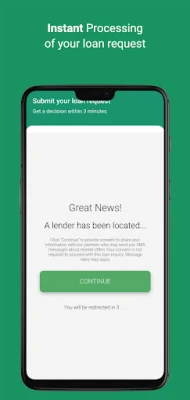

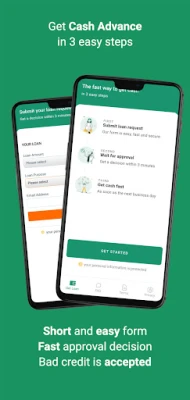

More About Instant Cash Advance Loan App

This app is designed to help people with bad credit get quick cash to cover unexpected expenses. It only takes three simple steps to use the app: choose the amount you need, enter your personal and employment details, and wait a few minutes to see if you've been connected to a lender. If approved, the cash will be deposited into your bank account as soon as the next business day. To use the app, you must be a legal US resident over the age of 18, have a monthly income of at least $1,000, and have a checking account for the loan to be deposited into. The app is designed to cater to different financial needs, allowing users to request the amount that suits them best. Whether it's a small payday loan or a larger amount for a dream vacation or home renovation project, the app's direct lenders offer various loan products with different repayment options. Using the app is quick, easy, and safe. After providing some personal information and selecting a loan amount, users will know within minutes if a lender is interested in making an offer. This process is much faster and more convenient than traditional bank loans. Additionally, the app uses secure encryption to protect users' sensitive information. One of the main benefits of this app is that it offers loans to people with bad credit or no credit history. Unlike traditional lenders who often reject applicants based solely on their credit score, the app's lenders consider other factors such as employment details and income when making lending decisions. It's important to note that the app itself is not a lender and does not make any lending decisions. Instead, it connects users with regulated independent lenders who can offer the advertised loan amounts. The app also does not guarantee loan approval, as each lender has their own criteria and policies. Repayment terms vary depending on the lender, loan amount, and type of loan, ranging from 65 days to 3 years. The app also provides information on APR (annual percentage rate), which is the rate at which a loan accrues interest. APRs can range from 6.63% to 35.99% and are based on factors such as the loan amount, cost, and term, as well as repayment amounts and timing. Before signing a loan agreement, lenders are legally required to disclose the APR and full terms and conditions of the loan. To give an example of how APR and fees are calculated, a $1,000 loan with a 17% APR taken out for one year would cost a total of $1,170, with a monthly payment of $97.50. It's important to carefully consider the APR and fees before agreeing to a loan, as they can significantly impact the total cost of the loan. Overall, this app provides a convenient and accessible option for those in need of quick cash, regardless of their credit history.

Rate the App

User Reviews

Popular Apps

Editor's Choice

All Games

All Games Action

Action Adventure

Adventure Arcade

Arcade Board

Board Card

Card Casual

Casual Educational

Educational Music

Music Puzzle

Puzzle Racing

Racing Role playing

Role playing Simulation

Simulation Sports

Sports Strategy

Strategy Trivia

Trivia Word

Word Art & Design

Art & Design Auto & Vehicles

Auto & Vehicles Beauty

Beauty Books & Reference

Books & Reference Business

Business Comics

Comics Communication

Communication Dating

Dating Education

Education Entertainment

Entertainment Events

Events Finance

Finance Food & Drink

Food & Drink Health & Fitness

Health & Fitness House & Home

House & Home Libraries & Demo

Libraries & Demo Lifestyle

Lifestyle Maps & Navigation

Maps & Navigation Medical

Medical Music & Audio

Music & Audio News & Magazines

News & Magazines Parenting

Parenting Personalization

Personalization Photography

Photography Productivity

Productivity Shopping

Shopping Social

Social Sport

Sport Tools

Tools Travel & Local

Travel & Local Video Players & Editors

Video Players & Editors Weather

Weather Android

Android Windows

Windows iOS

iOS Mac

Mac Linux

Linux