Latest Version

24.10.1

November 10, 2024

Farmers Group Inc

Finance

Android

0

Free

com.farmers.ifarmers

Report a Problem

More About Farmers Insurance Inc.

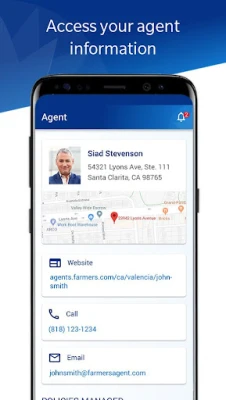

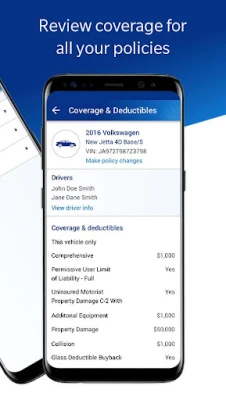

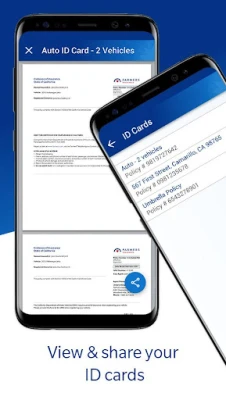

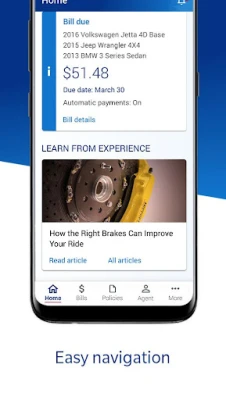

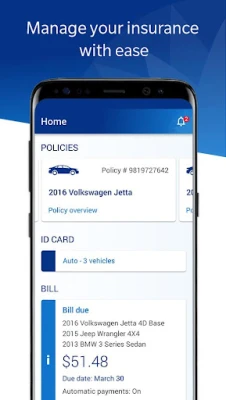

The Farmers Insurance Mobile App allows you to easily manage your insurance policies and payments on your Android device. With just a few taps, you can review your bills, make payments, and update your payment methods. You can also access ID cards for your auto and home policies, view policy documents, and start a claim right from your phone. Plus, you can request roadside assistance for emergencies like towing, tire changes, or battery charges.

One of the convenient features of the app is the ability to log in with Fingerprint ID, making the process hassle-free. The app also has a "Remember Me" feature that recognizes your phone after you've used it to sign in, making it even easier to access your account.

The app is brought to you by Farmers Insurance Exchange, Fire Insurance Exchange, Truck Insurance Exchange, Mid-Century Insurance Company, Civic Property and Casualty Company, Exact Property and Casualty Company, Neighborhood Spirit Property and Casualty Company, and Farmers Insurance Company of Washington (Bellevue, WA) or affiliates. In Texas, insurance is underwritten by Farmers Insurance Exchange, Fire Insurance Exchange, Truck Insurance Exchange, Mid-Century Insurance Company, Farmers Texas County Mutual Insurance Company, Mid-Century Insurance Company of Texas, or Texas Farmers Insurance Company. In New York, insurance is underwritten by Farmers Insurance Exchange, Truck Insurance Exchange, Mid-Century Insurance Company, or Farmers New Century Insurance Company. The home office is located in Los Angeles, CA.

The app also offers the option to purchase life insurance through Farmers New World Life Insurance Company, which is located in Bellevue, WA. However, this company is not licensed to sell insurance in the state of New York.

Each insurer listed above has sole financial responsibility for its own insurance policies. For a full list of all insurers, you can visit farmers.com. Keep in mind that not all insurers are authorized in every state, and not all products, coverages, and discounts may be available in your state. Restrictions, exclusions, limits, and conditions may apply, so it's important to speak with your agent for more details.

Rate the App

User Reviews

Popular Apps

Editor's Choice

All Games

All Games Action

Action Adventure

Adventure Arcade

Arcade Board

Board Card

Card Casual

Casual Educational

Educational Music

Music Puzzle

Puzzle Racing

Racing Role playing

Role playing Simulation

Simulation Sports

Sports Strategy

Strategy Trivia

Trivia Word

Word Art & Design

Art & Design Auto & Vehicles

Auto & Vehicles Beauty

Beauty Books & Reference

Books & Reference Business

Business Comics

Comics Communication

Communication Dating

Dating Education

Education Entertainment

Entertainment Events

Events Finance

Finance Food & Drink

Food & Drink Health & Fitness

Health & Fitness House & Home

House & Home Libraries & Demo

Libraries & Demo Lifestyle

Lifestyle Maps & Navigation

Maps & Navigation Medical

Medical Music & Audio

Music & Audio News & Magazines

News & Magazines Parenting

Parenting Personalization

Personalization Photography

Photography Productivity

Productivity Shopping

Shopping Social

Social Sport

Sport Tools

Tools Travel & Local

Travel & Local Video Players & Editors

Video Players & Editors Weather

Weather Android

Android Windows

Windows iOS

iOS Mac

Mac Linux

Linux