Latest Version

1.83.0

November 02, 2024

Dayforce

Finance

Android

0

Free

com.dayforce.wallet

Report a Problem

More About Dayforce Wallet: On-demand Pay

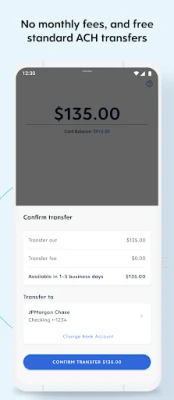

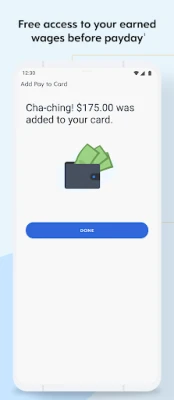

Dayforce Wallet is an application that allows you to access your pay on-demand, without any monthly fees or interest. There is also no minimum required spend, making it a convenient and flexible option for managing your finances. With Dayforce Wallet, you can make unlimited fee-free ATM withdrawals at in-network ATMs, and transfer money for free to your other bank accounts. You can also choose to transfer money instantly for a fee, giving you even more control over your finances.

To get started with Dayforce Wallet, simply download the app and create an account. Then, connect your account to Dayforce and activate your card to start making purchases online or in-store wherever Mastercard is accepted. It's a quick and easy process that can be completed in just three steps.

It's important to note that not all employers offer on-demand pay with Dayforce Wallet, so it's best to check with your employer to see if this option is available to you. Additionally, there may be blackout dates and limitations based on your employer's pay cycle and configurations. Dayforce Wallet is not responsible for administering on-demand pay.

There are some limits that apply to using Dayforce Wallet, such as restrictions and fees set by your bank. Any transfers made after 10:00pm PST/1:00am EST will be initiated the next business day. Additionally, while fee-free ATM access is available at in-network ATMs, there is a $2.50 fee for out-of-network ATMs and bank tellers, plus any additional fees charged by the ATM owner or bank. For more details on limits and fees, please refer to the Cardholder Agreement or Deposit Account Agreement.

While on-demand pay is free with Dayforce Wallet, there may be fees associated with certain card and account transactions. It's important to review the Cardholder Agreement or Deposit Account Agreement for a complete list of fees.

Dayforce Wallet also offers the option to receive early direct deposit, depending on your payor type, timing, payment instructions, and bank fraud prevention measures. This means that the availability of your pay may vary from pay period to pay period.

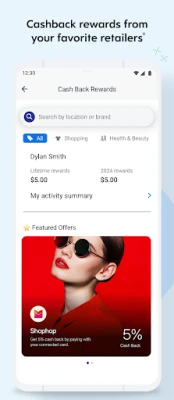

Finally, Dayforce Wallet Rewards is an optional feature that allows you to earn cash back on qualifying purchases made with your Dayforce Wallet Card. You can opt-out at any time and offers are based on your shopping habits. Cash back is credited to your card and may take up to 90 days to appear. It's important to note that GO2bank is not affiliated with or endorses the rewards program. For more information on how transaction data is used, please refer to the Dayforce Wallet Mobile App Terms of Use and Privacy Statement, as well as the Rewards Terms and Conditions.

Overall, Dayforce Wallet is a convenient and flexible option for managing your finances, with no monthly fees, interest, or minimum required spend. With features like on-demand pay, fee-free ATM withdrawals, and the option for early direct deposit and cash back rewards, it's a great tool for staying on top of your finances. Banking services are provided by Green Dot Bank, and the Dayforce Wallet Mastercard is issued by Green Dot Bank d/b/a/ GO2bank, Member FDIC, under a license from Mastercard International Incorporated.

Rate the App

User Reviews

Popular Apps

Editor's Choice

All Games

All Games Action

Action Adventure

Adventure Arcade

Arcade Board

Board Card

Card Casual

Casual Educational

Educational Music

Music Puzzle

Puzzle Racing

Racing Role playing

Role playing Simulation

Simulation Sports

Sports Strategy

Strategy Trivia

Trivia Word

Word Art & Design

Art & Design Auto & Vehicles

Auto & Vehicles Beauty

Beauty Books & Reference

Books & Reference Business

Business Comics

Comics Communication

Communication Dating

Dating Education

Education Entertainment

Entertainment Events

Events Finance

Finance Food & Drink

Food & Drink Health & Fitness

Health & Fitness House & Home

House & Home Libraries & Demo

Libraries & Demo Lifestyle

Lifestyle Maps & Navigation

Maps & Navigation Medical

Medical Music & Audio

Music & Audio News & Magazines

News & Magazines Parenting

Parenting Personalization

Personalization Photography

Photography Productivity

Productivity Shopping

Shopping Social

Social Sport

Sport Tools

Tools Travel & Local

Travel & Local Video Players & Editors

Video Players & Editors Weather

Weather Android

Android Windows

Windows iOS

iOS Mac

Mac Linux

Linux