Latest Version

6.8.2

December 11, 2024

NetSpend

Finance

Android

0

Free

com.netspend.product.android

Report a Problem

More About Classic Netspend

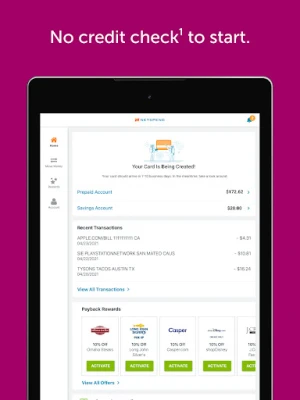

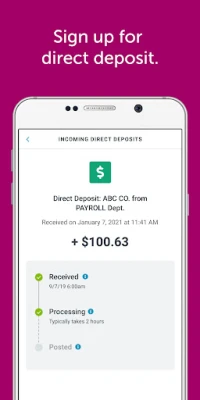

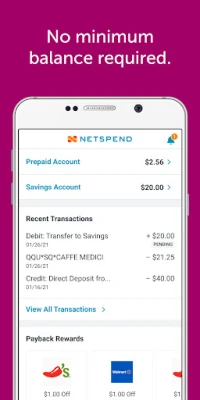

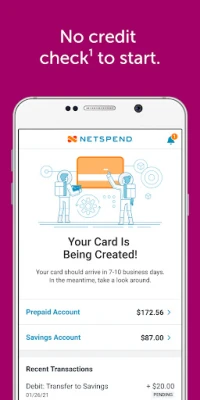

The Netspend All-Access account is a deposit account that offers faster funding compared to traditional banking practices. This means that funds are made available to customers upon receipt of payment instruction, rather than waiting for the funds to settle. However, there may be delays in availability due to fraud prevention measures. Early access to funds is also dependent on the payor's support of direct deposit and the timing of their payment instruction.

This service is provided by Netspend Corporation and its authorized agents, and they do not charge for it. However, customers should be aware that their wireless carrier may charge for messages or data related to this service.

There is no cost for online or mobile transfers between Netspend cardholders, but a fee of $4.95 applies for transfers conducted through a Netspend Customer Service agent. The Netspend Network is subject to fees, limits, and restrictions imposed by Netspend and other third parties.

The Netspend Visa Prepaid Card and Netspend Prepaid Mastercard are issued by The Bancorp Bank, Pathward™, National Association, and Republic Bank & Trust Company, under license from Visa U.S.A. Inc. and Mastercard International Incorporated, respectively. These cards can be used wherever Visa debit or Debit Mastercard is accepted. Netspend is a registered agent of the issuing banks and certain products and services may be licensed under U.S. Patent Nos. 6,000,608 and 6,189,787. Activation, ID verification, and funds availability are required for use of the card account, and transaction fees and terms and conditions apply.

The Netspend All-Access deposit account is established by Pathmark, N.A., and offered by Republic Bank & Trust Company, both of which are members of the FDIC. Netspend is a service provider to these banks and certain products and services may be licensed under U.S. Patent Nos. 6,000,608 and 6,189,787. Fees, terms, and conditions apply to this account.

Rate the App

User Reviews

Popular Apps

Editor's Choice

All Games

All Games Action

Action Adventure

Adventure Arcade

Arcade Board

Board Card

Card Casual

Casual Educational

Educational Music

Music Puzzle

Puzzle Racing

Racing Role playing

Role playing Simulation

Simulation Sports

Sports Strategy

Strategy Trivia

Trivia Word

Word Art & Design

Art & Design Auto & Vehicles

Auto & Vehicles Beauty

Beauty Books & Reference

Books & Reference Business

Business Comics

Comics Communication

Communication Dating

Dating Education

Education Entertainment

Entertainment Events

Events Finance

Finance Food & Drink

Food & Drink Health & Fitness

Health & Fitness House & Home

House & Home Libraries & Demo

Libraries & Demo Lifestyle

Lifestyle Maps & Navigation

Maps & Navigation Medical

Medical Music & Audio

Music & Audio News & Magazines

News & Magazines Parenting

Parenting Personalization

Personalization Photography

Photography Productivity

Productivity Shopping

Shopping Social

Social Sport

Sport Tools

Tools Travel & Local

Travel & Local Video Players & Editors

Video Players & Editors Weather

Weather Android

Android Windows

Windows iOS

iOS Mac

Mac Linux

Linux