Latest Version

9.0.52

November 06, 2024

Albert - Budgeting & Banking

Finance

Android

0

Free

com.meetalbert

Report a Problem

More About Albert: Budgeting and Banking

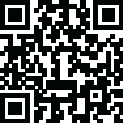

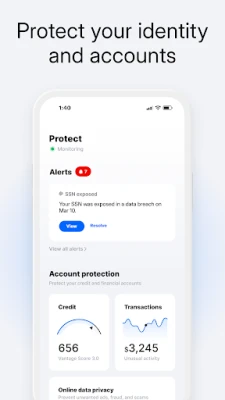

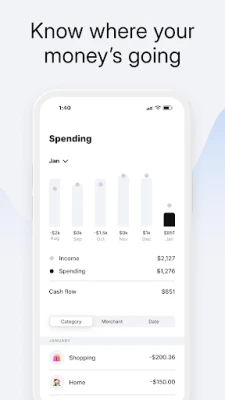

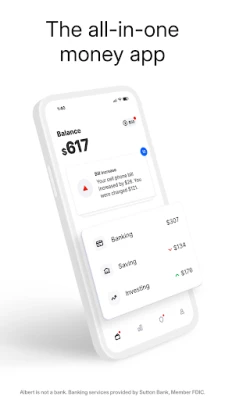

Albert is an application that helps you manage your money in a smarter way. It is not a bank, but it offers various services to help you save and spend more efficiently. With Albert, you can track your budget and spending across multiple accounts, keep track of subscriptions, and receive smart alerts to help you save more and spend less. You can also save and invest automatically, and even get up to $250 in overdraft coverage. Additionally, Albert offers services to monitor your identity and credit score, as well as access to finance experts.

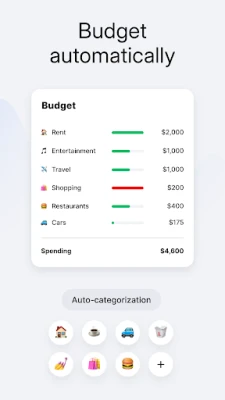

One of the main features of Albert is its ability to help you keep track of where your money is going. You can manage your monthly budget, receive personalized spending insights, and see all your accounts in one place. This makes it easier to stay on top of your finances and make informed decisions about your spending.

Albert also offers banking services through its partnership with Sutton Bank, Member FDIC. This includes features such as overdraft coverage up to $250, getting paid up to 2 days early with direct deposit, and earning cash back rewards. These services are designed to make banking with Albert more convenient and beneficial for its users.

In addition to banking services, Albert also offers tools to help you save smarter. You can set up automatic savings, create and track goals, and even earn cash bonuses. This can help you reach your financial goals faster and more efficiently.

For those interested in investing, Albert offers guided investing services. This includes the ability to invest automatically, buy stocks and ETFs, and access managed portfolios. However, it's important to note that investing accounts with Albert are not FDIC insured or bank guaranteed, and involve the risk of loss.

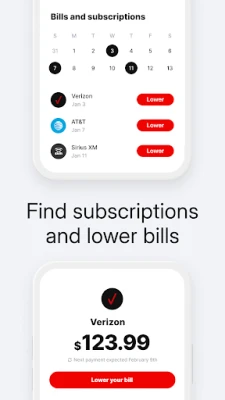

To protect your money, Albert also offers identity protection, credit score monitoring, and real-time alerts. This can help you stay on top of any potential threats to your finances and take action to protect yourself.

It's important to note that there are disclosures and fees associated with using Albert. The Albert Subscription costs $9.99/month, while the Genius package, which includes additional features, has a maintenance fee of $14.99/month. There are also fees associated with overdraft coverage and investing services. It's important to read the terms and disclosures carefully before signing up for any services with Albert.

In summary, Albert is an application that offers a variety of services to help you manage your money more effectively. From budgeting and banking to saving and investing, Albert has tools and features to help you reach your financial goals. However, it's important to carefully consider the fees and disclosures associated with using the app before signing up for any services.

Rate the App

User Reviews

Popular Apps

Editor's Choice

All Games

All Games Action

Action Adventure

Adventure Arcade

Arcade Board

Board Card

Card Casual

Casual Educational

Educational Music

Music Puzzle

Puzzle Racing

Racing Role playing

Role playing Simulation

Simulation Sports

Sports Strategy

Strategy Trivia

Trivia Word

Word Art & Design

Art & Design Auto & Vehicles

Auto & Vehicles Beauty

Beauty Books & Reference

Books & Reference Business

Business Comics

Comics Communication

Communication Dating

Dating Education

Education Entertainment

Entertainment Events

Events Finance

Finance Food & Drink

Food & Drink Health & Fitness

Health & Fitness House & Home

House & Home Libraries & Demo

Libraries & Demo Lifestyle

Lifestyle Maps & Navigation

Maps & Navigation Medical

Medical Music & Audio

Music & Audio News & Magazines

News & Magazines Parenting

Parenting Personalization

Personalization Photography

Photography Productivity

Productivity Shopping

Shopping Social

Social Sport

Sport Tools

Tools Travel & Local

Travel & Local Video Players & Editors

Video Players & Editors Weather

Weather Android

Android Windows

Windows iOS

iOS Mac

Mac Linux

Linux